Latest Articles

-

eOne Music changes name to MNRK Music Group

[ad_1]

eOne Music changed its name to MNRK Music Group, effective immediately.

The name MNRK (pronounced Monarch) follows Hasbro’s sale of its eOne music division to entities controlled by Blackstone for US $ 385 million earlier this year. Paydaypot

The deal adds to a portfolio of music companies under Blackstone that also includes the SESAC music rights organization.

Assets held by eOne Music include catalog Death Row Records and Dualtone Music Group, in addition to music production house Audio Network, which eOne acquired for approximately $ 215 million in April 2019.

MNRK Music Group will now operate as a self-sustaining, consolidated music company focused on recordings, editing, and artist management.

Chris Taylor will continue to lead MNRK Music Group as President and CEO.

Taylor has led the group since 2016 and has expanded the company’s burgeoning artist and music publishing business.

Additionally, MNRK Music Group will continue to work closely with eOne’s television and film divisions, with several projects to be released in 2021, including the soundtracks for the movie “My Little Pony” and the eOne / Netflix movie “The Starling “, and music from British Preschool Animated TV Series Peppa Pig.

The company will also continue to provide music oversight for many upcoming film and television projects.

Our migration as a preferred destination for musical talent is taking a giant leap forward today with a new name and new owners who are incredibly well-resourced and as excited as we are about the opportunity.

Chris Taylor, MNRK

MNRK Music Group’s roster includes The Lumineers, Brandy, The Game, Blueface, Juicy J, Pop Evil, Shovels and Rope and Jonathan McReynolds; management clients Kaytranada, Lupita Infante, Powfu, Boston Bun, Lights, Arkells; and publish songs recorded by Mariah Carey, Celine Dionne, Cardi B and others.

MNRK Music Group has offices around the world, including New York, Los Angeles, Toronto, Nashville, Miami, London, Hamburg and Melbourne.

MNRK Music Group celebrates the 20th anniversary of Dualtone Music Group, the 30th anniversary of Death Row Records.

Taylor said, Our migration as a premier destination for musical talent is taking a giant leap forward today with a new name and new owners who are incredibly well-resourced and as excited about the opportunity as we are. We are ready to fly!

MBW has long predicted that Hasbro would eventually dump eOne Music, after Hasbro acquired the operation as part of a $ 4 billion takeover of Entertainment One in August 2019.

Music trade around the world

[ad_2]

-

Whiskey in the Jar: Traditional Irish Pub Songs and Tunes

Traditional Irish pub songs and tunes have long held a special place in the hearts of music lovers, both within Ireland and across the ... -

Whiskey Ballads: Irish Pub Songs

Irish pub songs, often referred to as whiskey ballads, hold a special place in the hearts and culture of Ireland. These songs are characterized ... -

Whiskey Ballads: Drinking Games in Irish Pub Songs

Drinking and music have long been intertwined, with songs often serving as a backdrop for communal revelry. Irish pub songs in particular are well-known ... -

Traditional Tunes: Irish Pub Songs

Traditional Tunes: Irish Pub Songs Imagine yourself sitting in a cozy pub, surrounded by the warm glow of dimmed lights and the lively chatter ... -

Traditional Instruments in Irish Pub Songs: The Whiskey Ballads

In the realm of Irish pub songs, there exists a rich and vibrant tradition of incorporating traditional instruments to create an atmosphere that is ... -

The Wild Rover: Traditional Irish Pub Songs and Tunes

Traditional Irish pub songs and tunes hold a significant place in the rich cultural heritage of Ireland, evoking feelings of nostalgia, camaraderie, and national ... -

The Melodies: Irish Pub Songs and Folk Music

The Melodies: Irish Pub Songs and Folk Music have captivated audiences for centuries, transporting listeners to the lively atmosphere of traditional Irish pubs. One ... -

The Art of Pub Decor: Enhancing Irish Pub Songs with Authentic Drinking Atmosphere

The Art of Pub Decor: Enhancing Irish Pub Songs with Authentic Drinking Atmosphere In the world of traditional Irish pub songs, there is a ... -

Singing Techniques for Whiskey Ballads: Unlocking the Soulful Sounds of Irish Pub Songs

In the world of traditional Irish pub songs, whiskey ballads hold a special place. These soulful melodies, often accompanied by the rich tones of ... -

Session Music: The Role in Irish Pub Songs and Folk Music

Session music plays a pivotal role in the vibrant realm of Irish pub songs and folk music. This form of musical performance is characterized ... -

Rocky Road to Dublin: Traditional Irish Pub Songs and Tunes

Traditional Irish pub songs and tunes have long been cherished for their ability to transport listeners to the lively atmosphere of an authentic Irish ... -

Rebel Songs: The Irish Pub Folk Music

In the realm of folk music, certain genres and subgenres have emerged as powerful expressions of cultural identity and resistance. One such genre is ... -

Pub Trivia: The Secrets of Irish Pub Classics

Irish pubs have become renowned worldwide for their warm and inviting atmosphere, where patrons can gather to socialize over a pint of Guinness or ... -

Pub Quizzes: Irish Pub Songs and Drinking Songs

In recent years, pub quizzes have become a popular pastime among individuals seeking an entertaining and intellectually stimulating evening at their local Irish pubs. ... -

Pub History: Irish Pub Songs and Drinking Songs

In the realm of pub culture, Irish pubs have long held a place of prominence. These establishments not only serve as social gathering spaces ... -

Pub Games: Uncover the Fun in Irish Drinking Songs

Pub games have long been a cherished pastime in Irish culture, providing an interactive and lively experience for patrons. One such pub game that ... -

Pub Food: The Delicious Menu of Irish Drinking Songs

Pub food has long been associated with traditional Irish drinking songs, creating a unique and enjoyable dining experience for patrons. The combination of hearty ... -

Pub Folklore: Irish Pub Songs and Drinking Songs

In the realm of Irish pub culture, a vibrant tradition of folklore has flourished through the ages. Central to this cultural tapestry are the ... -

Molly Malone: Irish Pub Songs and Traditional Tunes

In the realm of Irish pub songs and traditional tunes, one name that often resonates with enthusiasts is Molly Malone. Her iconic status as ... -

Live Performances: Irish Pub Classics

Live performances have long been an integral part of the Irish pub culture, captivating audiences with their spirited renditions of traditional Irish music. These ... -

Jigs and Reels: The Irish Pub Songs Folk Music Connection

The Irish pub songs and folk music have a deep-rooted connection, intertwining cultural heritage with expressive melodies. This article explores the rich tapestry of ... -

Irish Traditions: Whiskey Ballads in Irish Pub Songs

Irish pub culture is renowned for its vibrant atmosphere, lively music, and rich traditions. Among these traditions lies a unique subset of Irish pub ... -

Irish Pub Songs: Uncovering the Whiskey Ballads of Pub Culture

Irish pub songs have long been an integral part of the rich cultural tapestry that characterizes Ireland. These spirited and melodic tunes, often accompanied ... -

Irish Pub Songs: A Guide to Credit Check Loans

Ireland is known for its lively pub culture, where friends gather to enjoy a pint of Guinness and sing along to traditional Irish folk ... -

Irish Pub Classics: Authentic Dishes in the Melody of Irish Pub Songs

Irish Pub Classics have long been celebrated for their rich flavors and hearty ingredients, offering a taste of tradition that resonates with both locals ... -

Irish Jigs: The Rhythm of Irish Pub Classics

Irish jigs have long been recognized as the quintessential rhythm of Irish pub classics, captivating audiences worldwide with their infectious melodies and lively beats. ... -

Folklore and Legends: Whiskey Ballads in Irish Pub Songs

Folklore and legends have long been intertwined with cultural heritage, serving as vessels for storytelling and preserving the collective memory of a community. One ... -

Fields of Athenry: The Traditional Tunes of Irish Pub Songs

The traditional tunes of Irish pub songs have long been a significant aspect of Ireland’s cultural heritage. These lively and melodic compositions not only ... -

Drinking Songs: The Irish Pub Song Tradition

The tradition of drinking songs holds a prominent place in the cultural fabric of Irish pubs. These lively tunes, often accompanied by raucous singing ... -

Danny Boy: The Iconic Irish Pub Song and Traditional Tune

The song “Danny Boy” holds a special place in the hearts of many, evoking feelings of nostalgia and patriotism for those with Irish heritage. ... -

Credit Check Loans: The Irish Pub Songs Connection

In the realm of financial services, credit check loans have gained significant popularity due to their accessibility and convenience. These types of loans allow ... -

Ceilidh Dancing: Unleashing the Magic of Irish Pub Songs

Ceilidh dancing, a lively and spirited form of traditional Irish folk dance, has long been associated with the enchanting atmosphere of Irish pub songs. ... -

Ballads and Balladeers: Irish Pub Songs and Folk Music

Ballads and balladeers have long been an integral part of Irish pub culture, serving as a means of storytelling and preserving the rich history ... -

[COLUMN] Are PPPs and other federal pandemic loans dischargeable in bankruptcy? —

MANY self-employed people have relied on the Paycheck Protection Program (PPP) and other federal pandemic loans to save their businesses from bankruptcy. If you ... -

Is R Kelly Really Broken? Disgraced singer trolled over negative $ 2 million net worth

[ad_1] Disgraced singer, songwriter and record producer R Kelly’s net worth has become a subject of ridicule on social media. “Yall…. Google R Kelly ... -

Melo Groove Steel Orchestra Gears Up For Carnival In South Florida – NBC 6 South Florida

[ad_1] With Miami and Broward’s carnival season just days away, NBC 6 News explores the history of steel drums, also known as steel pans. ... -

Rivertown Players Bring ‘9 to 5 the Musical’ to Lawrenceburg High School

There will be several shows this Thursday-Sunday. (Lawrenceburg, Ind.) – The Rivertown Players cordially invite you to our summer production of “9 to 5 ... -

Ron Miles, discreet master of the jazz cornet, died at 58

Ron Miles, whose brilliant and generously understated cornet playing made him one of contemporary jazz’s most rewarding bandleaders, but also one of its most ... -

Garifuna singer Ifeanyi Elswith releases a powerful and poignant single for Valentine’s Day

In the summer of 2020, local Garifuna musician Ifeanyi Elswith released the album All Festyle, which Gossip Wolf hailed as a “star turn” that ... -

Ed Sheeran | Ed Sheeran becomes the first artist to reach 100 million followers on Spotify

Ed Sheeran has become the first artist to reach 100 million followers on Spotify. The 31-year-old megastar has taken the next step in his ... -

Tejano singer and musician Gary Hobbs performed Friday night at the Topeka Performing Arts Center

TOPEKA (KSNT) — Tejano singer and musician Gary Hobbs performed Friday night at the Topeka Performing Arts Center. Hobbs grew up in Eagle Pass, ... -

How Palestinian Musicians Are Bringing Old Folk Songs To Life

Young Palestinians are reintroducing folk music using new musical instruments and styles, adding new topics in the lyrics such as unity, love and society. ... -

Girl groups made British pop great – so where did all the good ones go? | pop and rock

JThe girl group is in crisis. As Little Mix take a break and wrap up their Confetti Tour, billed as their last gig “for ... -

Steely Dan’s Donald Fagen teases his first solo album since 2012

[ad_1] At the start of the pandemic, Steely Dan’s Donald Fagen joked in Rolling stone that he was in his 40s “hanging out well ... -

“A Quick 5” with Vanessa Collier, blues saxophonist, singer and songwriter

[ad_1] Vanessa Collier, blues saxophonist, singer and songwriter Photo by Jeff Fasano. On October 15 and 16, 2021, the Columbia Festival of the Arts ... -

Richard Carpenter Revisits Best Selling Musical Duo With Late Sister Karen With New Memoir “Carpenters: The Musical Legacy”

[ad_1] LOS ANGELES – 47 years ago at the American Music Awards, the Carpenters won the Favorite Pop Group honor. All these years later, ... -

Artist Spotlight: MUNA is moving full speed ahead into new musical territory

In mid-2013, three students from the University of Southern California decided to start a band together, releasing their first EP titled The EP speaker ... -

Summersalt on tour in Europe to share the music and culture of Meghalaya, North East India

[ad_1] SHILLONG, November 1: The town’s folk fusion troupe Summersalt is expected to tour three European countries, including Germany, Denmark and Switzerland, to share ... -

2022 American Music Awards Introduce New Category of Favorite K-Pop Artists + Announce This Year’s Nominees

The 2022 American Music Awards (AMA) have announced this year’s nominees! Nominations for the 2022 AMAs were announced on October 13. According to Billboard, ... -

A judge awarded a 35-year-old man who had filed for bankruptcy $100,000 in school loan forgiveness

The context of the cancellation of student loans Two weeks ago, news broke that a thirty-five-year-old man named Ryan Wolfson had achieved the almost ... -

Casting Crowns shares the album “Healer (Deluxe)”

Crown casting (Image courtesy of Merge PR) Fri, August 26, 2022 4:05 p.m. Music Video for New Song “No Hurt” Featuring Urban Bicycle Food ... -

How classical music confronts its colonial past and present

[ad_1] No work of Western classical music is more closely associated with the Christmas period than that of the German-born composer George Frideric Handel ... -

BTS’s ‘Proof’ Album To Be Released As A 48-Track Anthology On Friday

K-pop superstars BTS have confirmed that their latest album “Proof” will span three CDs and consist of 48 tracks. It will fall on Friday. ... -

ENHYPEN Releases Exhilarating Music Video For “Future Perfect (Pass the MIC)”

K-pop boy group ENHYPEN has released an exciting music video for their brand new single “Future Perfect (Pass the MIC).” In the new visual, ... -

Colorado bankruptcies drop 40% in April – Loveland Reporter-Herald

Colorado bankruptcy filings fell 40% in April from the same period a year ago, continuing a downward trend seen throughout 2021 and so far ... -

Riddy Arman’s self-titled album is about a desire for both human connection and isolation

So, I finally got to listen to Riddy Arman’s self-titled album from 2021 the other day. He had been on my list for a ... -

Liz Truss warned of massive bankruptcies if companies remain in limbo on energy bills | Liz Truss

Liz Truss faces a political and economic baptism of fire this week with warnings of massive bankruptcies across the economy – even as the ... -

🌱Big Sound from the band Tiny Ocean + Celebrate Juneteenth!

Hello everyone. I’m here with your Wednesday edition of the Essex-Chester-Deep River Daily, full of all the things you need to know about what’s ... -

Listen to Yo Gotti’s Double Disc Album ‘CM10: Free Game’

Music mogul and Southern veteran Yo Gotti has released his eleventh studio album, CM:10 free game, which is a double-disc project that showcases both ... -

Punjabi singer Moosewala joins Congress

[ad_1] Popular Punjabi singer Sidhu Moosewala, hired last year for allegedly promoting gun culture through his song, joined Congress on Friday. The singer joined ... -

Bankruptcy clause of the US Constitution: on the move!

“Congress shall have the power to . . . implement . . . Uniform Bankruptcy Laws Across the United States.” – Bankruptcy clause of ... -

Fewer bankruptcies in 2020

Download CSVShow data tableNumber of bankruptcies of companies and institutions (excluding sole proprietorships) adjusted for hearing days Number of bankruptcies of companies and institutions ... -

The Dead Daisies Announce New Album Radiance For September 2022 Release, Share “Shine On” And Title Track

Lucy Yang July 24, 2022 – 5:03 p.m. Today’s news in the music industry, The Dead Daisies announce that they are about to release ... -

Remembering Legendary Doors Lead Vocalist Jim Morrison | Culture | Reports on the arts, music and lifestyle of Germany | DW

[ad_1] Multi-talented artist, charismatic leader, coveted lover: at the height of his career, Jim Morrison quite lived up to the image of the proverbial ... -

Peter Mulvey with special guest J. Schmitt opening at Oswego Music Hall | Arts and entertainment

[ad_1] OSWEGO COUNTY – Peter Mulvey with opening special guest J. Schmitt will appear on the main stage of Oswego Music Hall on Saturday ... -

Barbra Streisand, Lea Salonga, more mourn Stephen Sondheim

[ad_1] Tributes quickly flooded social media after Stephen Sondheim’s death as artists and writers hailed a theater giant: “Rest In Peace, Stephen Sondheim, and ... -

Local artist uses drums to bring music therapy and education to Tyler Daycare | Local News

A local artist recently brought his program that uses drums as a medium of communication to children at a daycare center in Tyler. Casey ... -

Call for group singing leaders

Sing Ireland is seeking group singing facilitators for its panel for delivering the YouthSing Ireland program for 2022/2023. This initiative will provide opportunities for ... -

XFL players get fucked by defunct league over unpaid wages

Getty Images The XFL 2.0 debuted in the spring of 2020 and immediately saw some success Fans filled the stadiums and watched on TV, ... -

Musician Louis Baker Talks Duality, Art, and Not Being “The Jazz Guy”

PROVIDED Wellington musician Louis Baker is one of the headliners of the Wellington Jazz Festival 2022. Louis Baker is keen to point out that ... -

Grammy-winning Oneida singer and activist Joanne Shenandoah has died aged 64

[ad_1] Joanne Shenandoah, who grew up in the Oneida nation of India before becoming a world-renowned singer and peace and human rights activist, has ... -

KessCo Announces Partnership With Sony Music The Thread Shop For Album Artwork License For Puzzle Line

[ad_1] The de.bored puzzles will feature album art from popular artists such as Jimi Hendrix Posted: October 14, 2021 at 9:41 a.m. EDT|Update: 1 ... -

Things to do this week in Philadelphia: concerts, exhibitions and more

The museum opens its latest exhibition this week with an opening reception on Thursday. The exhibition will focus on Swedish impressionist painters and sculptors ... -

Calendar Girls The Musical puts on a thriving good show in York

The true story of the Calendar Girls of the Rylstone Women’s Institute has traveled from print to stage to screen. Best of all is ... -

A generational musical celebration of the Coffs Harbor City Orchestra – News Of The Area

The Coffs Harbor City Orchestra Celebrations concert will feature musicians of all ages and a wide range of musical genres. GENERATIONS, the theme for ... -

Paul McCartney doesn’t really want to stop the show

[ad_1] His father, Jim, was a cotton seller and an amateur jazz musician. Although Paul grew up in Liverpool in a working-class housing estate, ... -

‘Harmony’ review: Barry Manilow Musical has pop prowess

Since 1997, singer-songwriter Barry Manilow and lyricist-librettist Bruce Sussman – the team behind iconic ’70s pop classics such as “Copacabana” – have sought to ... -

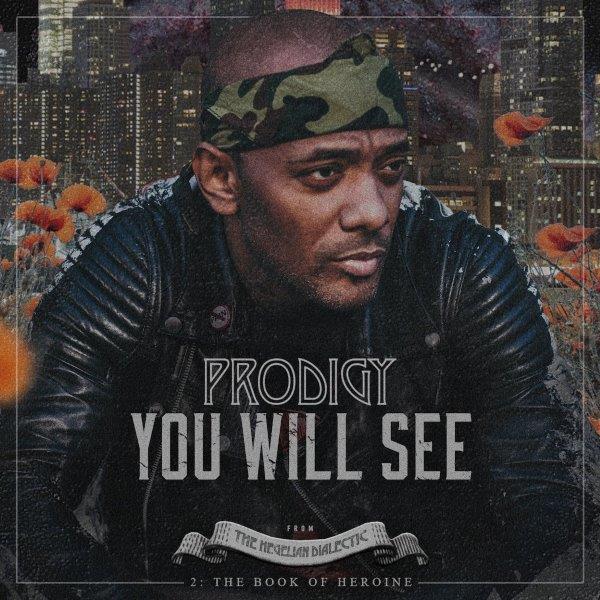

Stream Prodigy’s New Single ‘You Will See’, New Album Set To Be Released This Summer

The Estate of Prodigy have released the hip-hop icon’s new single “You Will See.” The single is Prodigy’s first song to be released since ... -

Lance Martin speaks at National Association of Bankruptcy Trustees Conference

June 16, 2022 Creditor rights lawyer Lance Martin recently attended the National Association of Bankruptcy Trustees conference in Vancouver, British Columbia, where he spoke ... -

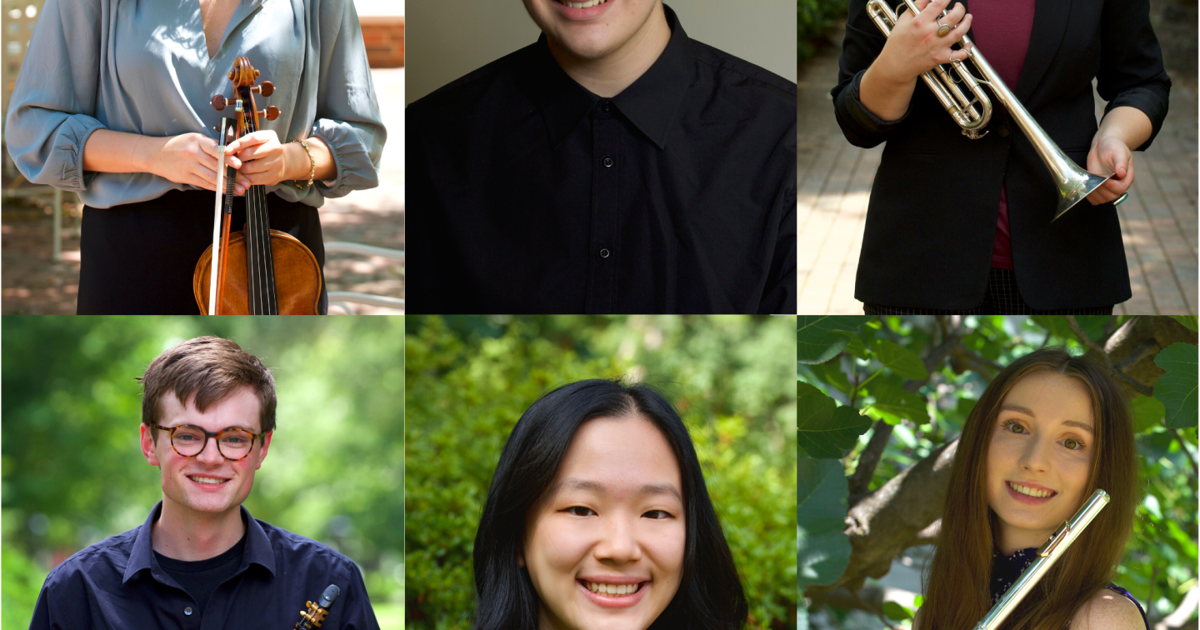

Eastern Music Festival Announces Six Young Artist Winners of the 2022 Concerto Competition | New

GREENSBORO, NC – Eastern Music Festival (EMF), a nationally acclaimed music festival and summer educational program based in the heart of North Carolina, announces ... -

Jamaica’s musical heritage in 60 songs, from Bob Marley to Popcaan

In the 60 years since Jamaica’s independence from England on August 6, 1962, the tiny Caribbean nation has created some of the world’s most ... -

James Blake turns to background music

In the age of streaming, music has become the fuel for the internet’s endless white noise machine. Lo-fi ambient music—much of it extracts and ... -

COUNTRY MUSIC SINGER JIMMIE ALLEN AND WIFE, ALEXIS, WELCOME BABY GIRL

[ad_1] Congratulations to Jimmie Allen and his wife, Alexis, who welcomed their baby girl, Zara James Allen, on Saturday (October 16). The country music ... -

Enrique Iglesias “shocks” Twitter; shares a video of him kissing a fan in Las Vegas

Enrique Iglesias shocked Twitter users by sharing a video of him kissing a fan at a recent dating event in Las Vegas. The singer, ... -

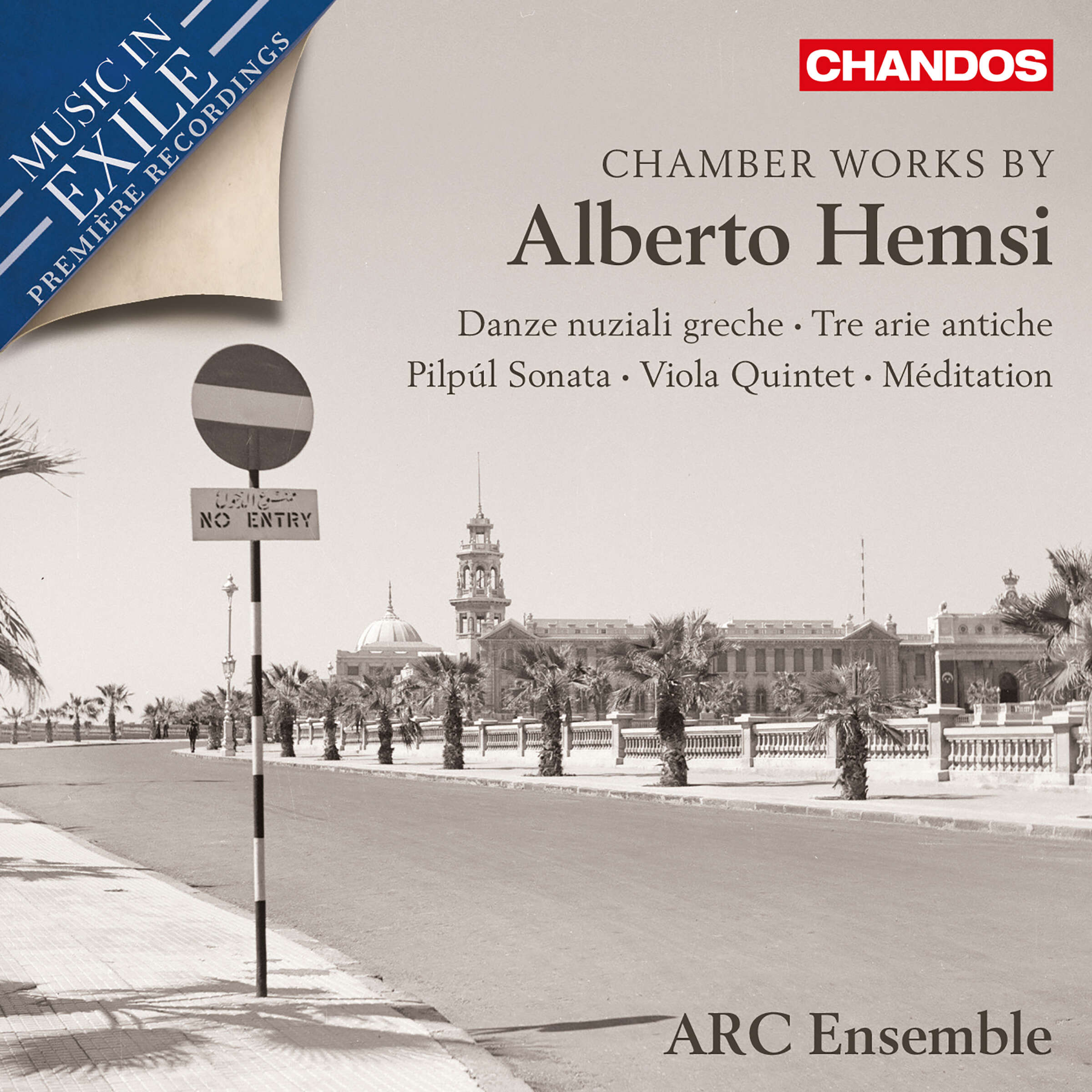

“Chamber Works by Alberto Hemsi”

The record is part of the band’s mission to seek out and recover 20th century music that has been suppressed or marginalized by repressive ... -

Detroit bankruptcy documentary to open 2022 Freep Film Fest

Detroit’s historic bankruptcy will be in the spotlight on the opening night of this year’s Freep Film Festival. “Gradually, Then Suddenly: The Bankruptcy of ... -

Dan Andriano announces a new album with the solo project The Bygones – Kerrang!

[ad_1] Alkaline Trio man Dan Andriano has announced details of an album with new solo project The Bygones. The group – completed by Randy ... -

Peter Gregson Shares Moby’s ‘Extreme Ways’ Remix

Acclaimed composer, cellist and entertainer Peter Gregson is the latest artist to be recruited for a release from Moby’s upcoming project Cover – Remixes, ... -

Malian singer Oumou Sangaré will make her Apollo Theater debut on October 29

The concert, presented by the World Music Institute, is part of the US-based non-profit Women’s Voices series celebrating the role of female artists in ... -

Foo Fighters drummer Taylor Hawkins dies at 50

Taylor Hawkins, the hard-hitting and charismatic drummer of Foo Fighters, the enduring Rock & Roll Hall of Fame band that won 12 Grammys and ... -

Jorge Drexler’s music bridges genres, generations and continents

At some point, he realized, “It’s not a burden. It is an identity. On previous albums, Drexler has sung on mass migration and parallel ... -

Gandhi in heels? The statue of Maria Callas is wrong | Maria callas

[ad_1] Drama in life, drama in posterity. For Maria Callas, Greece’s greatest diva, there is, even 44 years after her death, no relaxation of ... -

The Wesleyan Argus | Turkish and Turkmen musical traditions collide in a one-of-a-kind graduation recital

c/o Aaron Bittel Graduate Music Students Ridvan Aydinli MA ’22 and Mohammad Geldi Geldi Nejad MA ’23 filled the Memorial Chapel with music from ... -

Biden administration announces huge bankruptcy changes for student loans

President Joe Biden speaks about student debt relief at Delaware State University, Friday, October 19. … [+] February 21, 2022 in Dover, Del. (AP ... -

Courtney Barnett on being forced to quit: “I felt open in a different way” | Courtney barnett

[ad_1] AIn early 2020, as her home country burned down and the rest of the world woke up to a global pandemic, Courtney Barnett ... -

PXSSY PALACE Announces First Overflo Music and Arts Festival

LGBTQ+ arts platform PXSSY PALACE has announced its first-ever music and arts festival. As of 2020, LGBTQ+ events around the world have been limited ... -

Charlie Puth wants your body on new single ‘Light Switch’

Charlie Puth has released a new single, “Light Switch”. The upbeat pop song, which sees Puth sing about his attraction to a love interest, ... -

The Northern Lights Festival Boréal returns with live music

[ad_1] Breadcrumb Links Music Local entertainment Entertainment From September 10 to 11, the festival will feature Dan Mangan, Jeremy Dutcher and others Author of ... -

Who wrote Miranda Lambert’s “Strange” and what the song is about

Miranda Lambert released her ninth studio album, palomino, in April 2022. Ahead of the album’s release, the country singer released the song “Strange” as ... -

Electric vehicle manufacturer Electric Last Mile Solutions files for bankruptcy

U.S. commercial electric vehicle maker Electric Last Mile Solutions (ELMS) showcases its all-electric city utility van and commercial truck in Troy, Michigan, U.S., November ... -

Theater Review: “The Band Visit” at the John F. Kennedy Center for the Performing Arts

Sasson Gabay (Tewfiq) and Janet Dacal (Dina) in “The Band’s Visit” at the Kennedy Center. Photo by Evan Zimmerman The North American tour of ... -

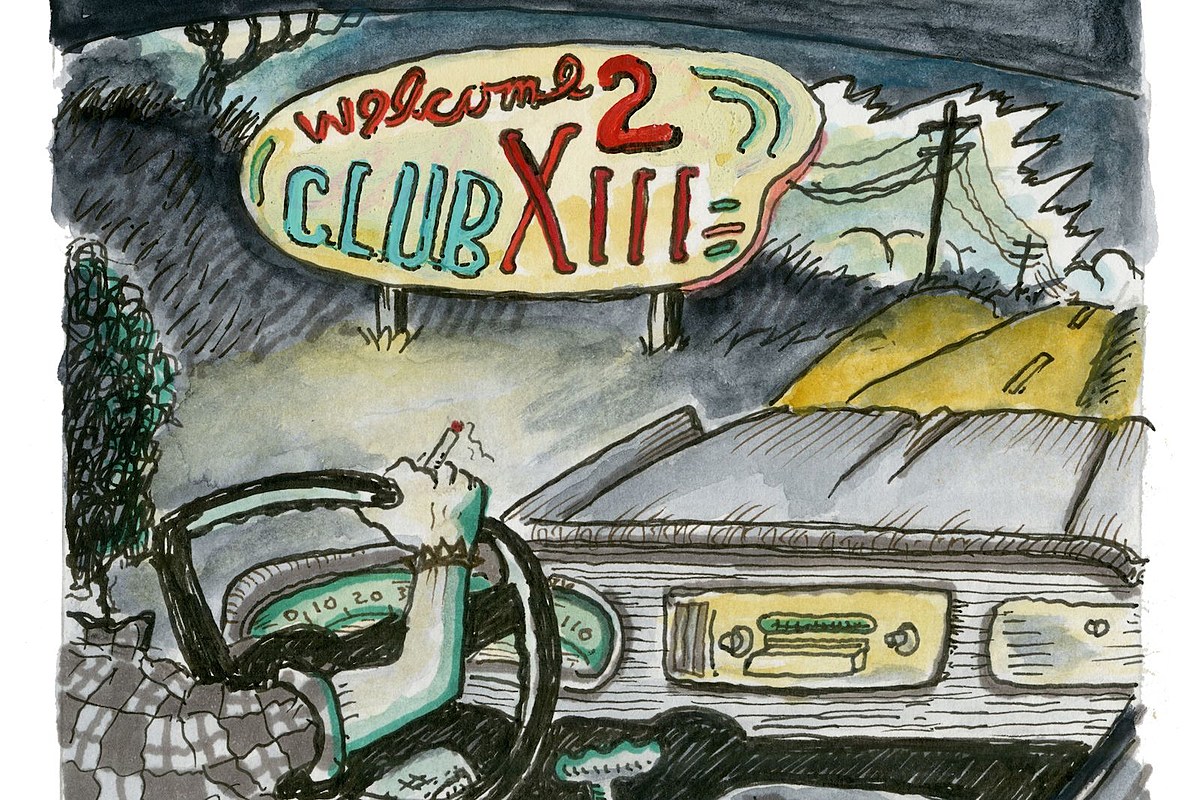

Drive-By Truckers Announce New Album, “Welcome 2 Club XIII”

Drive-By Truckers have announced the release of their 14th album, Welcome to 2 Club XIII, June 3. The song “Welcome 2 Club XIII” is ... -

Krispy Kreme enters the US market after five years of absence | IPO

Tell Homer Simpson: Krispy Kreme plans to float the U.S. stock market after a five-year gap, with sales of its donuts soaring as customers ... -

The WWII film “Wolf Hound” inspired by a secret Nazi air combat unit

The World War II thriller “Wolf Hound,” which has been in the works for nearly four years, is finally slated to hit theaters and ... -

Itzy Takes # 1 Album Sales on Billboard Chart with Debut Studio Album “Crazy In Love”

[ad_1] Looks like fans have gone loco for Itzy’s debut studio album. “Crazy In Love” and its title track “Loco”, which was released on ... -

ICE – Manager Licensing Administration (m / f / d) (DE)

ICE is the result of a grand vision for the music industry which harnesses years of combined expertise in the multi-territorial music market. We ... -

With his new album “Far In”, Helado Negro faces earthly anxieties

[ad_1] The end weighs heavily Helado Negro. Part of his unease stems from traditional concerns, like aging (the musician, born Roberto Carlos Lange, turned ... -

Covid News: At least 53 people test positive after high-profile dinner in Washington

A checkpoint in Ningbo, China. A growing number of Chinese cities are requiring truckers to take daily Covid PCR tests.Credit…Agence France-Presse — Getty Images ... -

JC Scholarly lets kids explore music and science interests

As a young girl, Linda Jaussi Christopher dreamed of being a professional singer, performing in her Idaho front yard for friends and strangers walking ... -

Musician Teddy Richards finally talks about his mother, Aretha Franklin

[ad_1] For years, a Detroit singer-songwriter diligently pursued his musical career, building a reputation for himself and making a steady living. Through it all ...

/cloudfront-us-east-1.images.arcpublishing.com/gray/7VO5PIJBC22VCNBKKBBMI4AQK4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VND3ZWB6DVNS5DH2V5XLYOKDHQ.jpg)